Privacy and Ethics in Payroll

Technical safeguards and workplace culture build on a legal compliance foundation to ensure employees feel respected and the autonomy to act responsibly and ethically while fulfilling their duties. It's about doing right by the people who keep the organisation running.

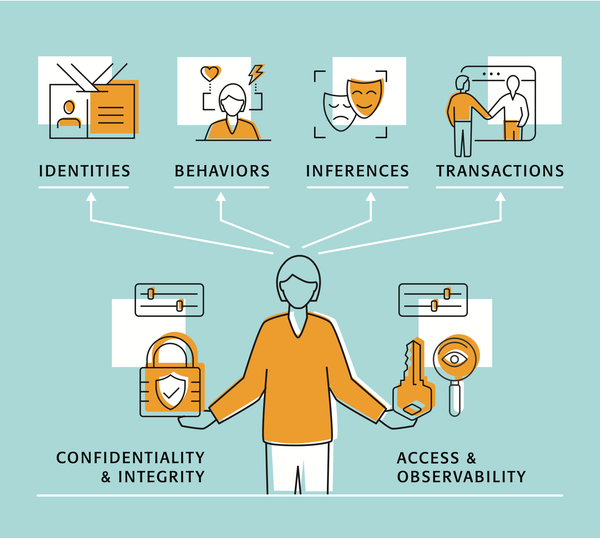

Ethics in Canadian payroll operations means more than just following the law. Processing personal information involves critical ethical responsibilities related to employee trust, privacy, and fairness. Payroll and HR leaders must ensure that data collection and use are transparent, limited to legitimate business purposes, and based on informed consent. Ethical handling of PI includes safeguarding sensitive information—such as health records, performance data, and personal identifiers—against unauthorised access or misuse. It also requires clear policies for data retention, accuracy, and employee rights to access or correct their information. As stewards of workplace culture and compliance, Payroll and HR leaders play a pivotal role in embedding data ethics into organisational practices, ensuring that respect for individual privacy is upheld alongside operational efficiency. It is important to note that it is easier to instil a culture of ethical processing of customer data if that is a reflection of how your organisation respects the dignity and autonomy of your employees.

Ethical Foundations

Ethical foundations in Canadian payroll operations are grounded in principles of integrity, confidentiality, objectivity, and professionalism. Payroll professionals are entrusted with highly sensitive personal and financial information, making it essential to act with discretion and uphold the trust of employees and employers alike. The National Payroll Institute’s Code of Professional Conduct emphasises avoiding conflicts of interest, maintaining technical competence, and treating all individuals with fairness and respect. Ethical payroll practice also involves a commitment to continuous learning, transparency in communication, and fostering a workplace culture that values privacy and accountability..

Legal Foundations

The legal foundations in Canadian payroll are built on compliance with a complex framework of federal and provincial legislation, including the Income Tax Act, Employment Standards Acts, Canada Pension Plan, Employment Insurance Act, and privacy laws. Payroll professionals must ensure accurate and timely remittance of deductions, proper classification of employees, and adherence to minimum employment standards. Legal compliance also includes safeguarding personal information under privacy legislation, maintaining appropriate records, and being prepared for audits or inquiries. Staying current with legislative changes is a core responsibility to ensure both organisational compliance and employee rights are protected.

Beyond Compliance

Ethics in payroll goes beyond compliance. It includes:

- Transparency: Employees should know what data is collected, why, and how it’s used.

- Consent: Even when consent isn’t legally required, ethical practice involves informing employees and respecting their preferences where possible 1.

- Minimisation: Only collect what’s necessary. For example, don’t ask for a SIN unless it’s required for tax reporting.

- Security: Payroll data must be protected with appropriate safeguards—technical, physical, and administrative.

- Accountability: Employers should have clear policies and training to ensure staff handle payroll data responsibly.

Common Ethical Dilemmas in Payroll

1. Overpayment Errors

When an employee is accidentally overpaid, the employer has a legal right to recover the funds. But the ethical question is how to do so fairly—especially if the employee relied on the money or the error was discovered months later.

2. Access to Salary Information

Payroll staff may have access to executive compensation or peer salaries. Sharing or gossiping about this information—even informally—violates ethical norms and privacy expectations.

3. Monitoring Attendance with Surveillance

Using biometric systems or GPS tracking to verify hours worked may be legal, but raises ethical concerns about employee autonomy and informed consent 2.

4. Third-Party Payroll Providers

Outsourcing payroll to third parties introduces risks. If the provider stores data outside Canada, it may be subject to foreign laws. Employers must weigh cost savings against the ethical duty to protect employee data 3.

5. Handling Payroll for Employees on Leave

Managing payroll for employees on disability or parental leave involves sensitive health and family information. Ethical practice requires discretion and empathy, not just procedural compliance.

Ethical Guidelines for Third-Party Payroll Providers

When outsourcing payroll, Canadian organisations should follow these ethical guidelines:

- Due Diligence: Vet providers for their privacy practices, data residency, and security controls. Ensure they comply with Canadian privacy laws 3.

- Data Residency: Prefer providers that store and process data within Canada to reduce exposure to foreign surveillance or legal access 3.

- Contractual Safeguards: Contracts should clearly define data ownership, breach notification timelines, audit rights, and subcontractor restrictions 3.

- Ongoing Oversight: Regularly audit the provider’s practices and ensure they meet evolving legal and ethical standards 3.

- Employee Transparency: Inform employees when their data is handled by a third party, including where it’s stored and how it’s protected 1.

These practices align with guidance from the Office of the Privacy Commissioner of Canada and the Office of the Superintendent of Financial Institutions 1 3.

Workplace Culture

Privacy-respecting and ethical payroll operations build trust and can increase organisational commitment in your workforce. When employees feel their information is handled ethically, it improves morale and reduces the risk of internal conflict or whistleblowing.

The Office of the Privacy Commissioner of Canada emphasises that fostering a culture of privacy is good for business and essential for compliance.

Conclusion

Ethical payroll practices are built on a foundation of legal compliance, which avoids penalties. Technical safeguards and workplace culture build on a legal compliance foundation to ensure employees feel respected and the autonomy to act responsibly and ethically while fulfilling their duties. It's about doing right by the people who keep the organisation running.

1: https://www.priv.gc.ca/en/privacy-topics/employers-and-employees/02_05_d_17

2: https://www.priv.gc.ca/en/opc-news/news-and-announcements/2023/an_230529/

3: https://www.osfi-bsif.gc.ca/en/guidance/guidance-library/third-party-risk-management-guideline